For an analysis of your situation, get in touch with one of our advisors

1 844 854-6055Toll free

Contact us

The 5,500-hour rule

Deduction rules

Do you operate a corporation? Do your employees combined work fewer than 5,500 hours a year? If so, the tax rules that come into force in 2017 directly concern you.

Possible tax rate increase

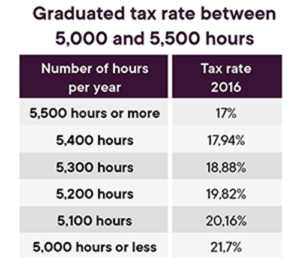

To be eligible for the Québec small business deduction (SBD), you will now have to make sure that your employees work at least 5,500 hours. Otherwise, you cannot benefit from the reduced tax rate on the first $500,000 of business income.

Hours matter!

For your yearly tax return, here are the key criteria to consider when calculating the number of hours worked:

- The hours must be worked and paid;

- A maximum of 40 hours per week per employee may be counted;

- You, the professional, are considered an employee, regardless of your compensation. Note that even if you work 60 hours a week, you can only count 40 hours in the calculation.

Pooled hours

If you belong to a group of professionals who have formed a partnership to share your income and your expenses, you should perhaps review your agreement.

Limited multiplication of the SBD

The measures announced in the 2017 federal budget change the application structure for the small business deduction (SBD) and result in significant changes in the tax rates for professionals.

| Before/Multiplication | Now/Simplification |

| Each professional could incorporate their company and bill the partnership under a service contract.

The structure allowed for the multiplication of the SBD among the different incorporated professionals and each could benefit from a tax rate of 18.50% on the first $500,000 of income. |

The small business deduction is shared by all the corporations of the professionals who are partners in the same partnership.

These measures also apply when the “association” operates as a corporation rather than a partnership. |

Simplifying the pool structure

An opportunity

These changes are an opportunity for all the professional partners of a partnership to review their agreement, consolidate it, and validate their mutual interest in collaborating and in benefiting from the synergies of the group.

Some groups may want to reorganize the way they operate and consider the possibility of the partners transferring their social shares to their corporation. Making the professionals’ corporations partners of the partnership will simplify the administration of the group.

Why simplify the pool structure?

There are many good reasons for doing so.

- Bill preparation and monitoring of accounts payable will no longer be necessary, since the corporation will no longer be a subcontractor of the pool.

- The distinction between professional activities and other, non-professional activities will no longer be necessary.

- Personal income will no longer be attributed for non-professional activities.

Be informed

Make things easier for yourself!

To assess the appropriateness of remaining in a pool, simplify its structure and facilitate the accounting management, fdp Private Wealth Management gives you access to all the resources you need to help you make the right choices.

Our team of tax specialists has the necessary expertise to advise you on the steps to take concerning your services pool, taking into account taxes changes and your situation.

Professionals you can trust

For more detailed answers and an in-depth analysis of your situation, place your trust in one of our advisors.