|

Professionals continue to adapt to the many changes that have been made to the incorporation rules. Here we will discuss the measures related to passive income and the small business deduction (SBD) of a CCPC, which have been in effect since January 1, 2019 for corporations with a December 31 year end. |

Our expert |

|

|

Anik Bougie, LL.M. Fisc., F. Pl., TEP |

What is the impact of the reform on a corporation’s passive income?

A corporation is normally taxed at lower rates on the first $500,000 of net professional income. For the fiscal year that began on January 1, 2019 and for all subsequent years, the business limit ($500,000) will be gradually reduced when the investment income of the corporation (and its associated corporations) exceeds $50,000. This measure may increase the corporation’s tax rate, where applicable. Remember that the business limit is the income threshold for eligibility for the small business deduction (SBD).

Rule: the reduction in the business limit is $5 for every dollar of investment income over $50,000. The business limit will therefore be completely eliminated when the investment income reaches $150,000 (($150,000 – $50,000) X 5 = $500,000).

What is included in a corporation’s total adjusted investment income:

-

- Interest income

- Dividend income

- The taxable portion of capital gains

- Net rental income, from which are deducted:

a. Investment expenses

b. Net capital losses carried forward from previous years

Note that certain investment income will not be treated according to the new rules, for example, gains arising from the sale of the assets of a practice.

An example to illustrate

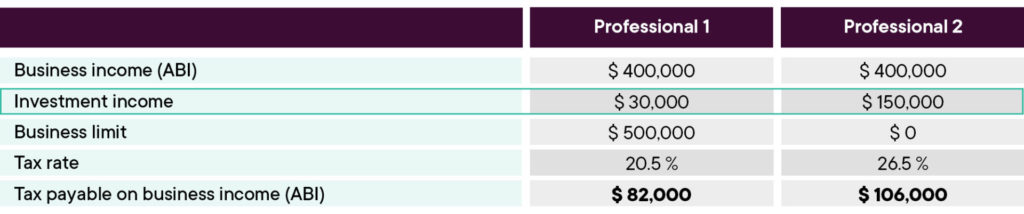

- Two incorporated professionals have fiscal years ending December 31.

- They each have professional income of $400,000.

- The first professional has annual investment income of $30,000; the second, $150,000.

- Since the total number of hours worked by the employees of each corporation is less than 5,000 hours, they are not entitled to the SBD in Quebec.

- For an incorporated professional with no employees, the tax impact of this new measure is equivalent to an additional tax of 6% on the income that was previously eligible for the SBD.

- In the case where the $500,000 business limit is completely lost, this could mean an increase in taxes payable of $30,000 ($500,000 X 6.00%) annually, based on 2020 rates.

- For an incorporated professional, whose corporation has a total of more than 5,500 paid hours per year, the additional tax could reach $62,500 ($500,000 X 12.5%) annually.

Possible strategies

- A professional who earns between $50,000 and $150,000 in investment income could review their investment portfolio or their compensation in order to reduce the impact of the new measures.

- For example, they could opt for a growth-oriented investment portfolio, which generates capital gains rather than interest income.

- Another strategy could be to realize losses in order to reduce the investment income for the fiscal year concerned.

- As for compensation, paying themself a salary rather than a dividend could prove beneficial, since a salary is an expense that is deductible from business income.

The case of young professionals

Considering the additional taxes, is incorporation still advantageous for a young professional?

An example

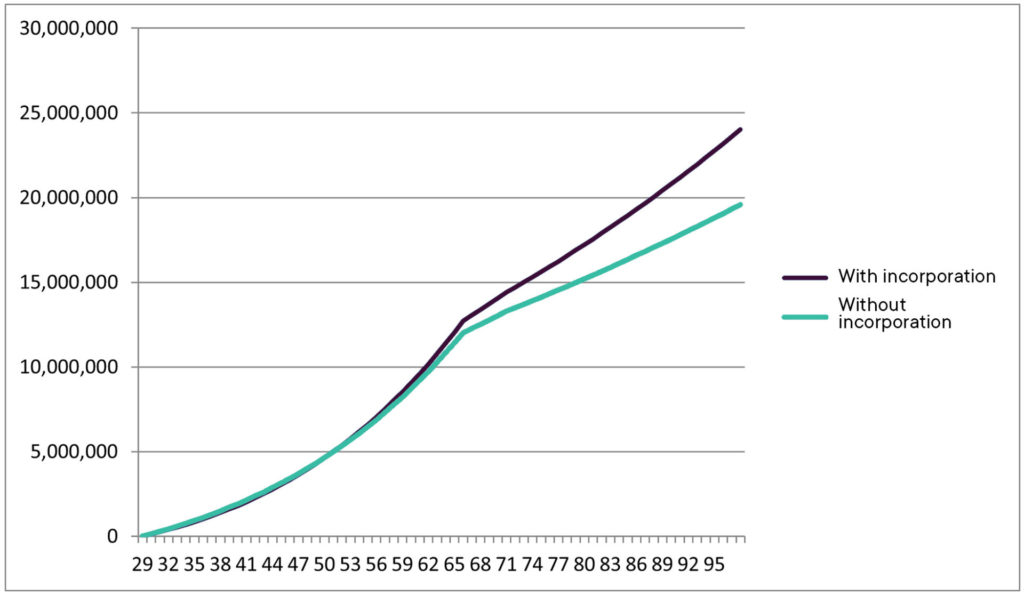

A 28-year-old professional who is just starting out and has no savings and no debt.

- His professional income is currently $400,000, indexed at 2% annually.

- He wants to retire at 65.

- Assume an annual cost of living of $75,000, also indexed at 2% annually.

- For investment income, we will use a rate of return of 4%.

In this example, it would be to the young professional’s advantage to incorporate, despite the new measures on passive income. In fact, the calculations show that his wealth net of tax would be approximately $12.7 million at age 65 with incorporation, versus $12 million without incorporation, a not insignificant difference of around $700,000. At the age of 85, that difference would increase to $2.7 million.

Analysis required

The new measures are complex, but they do not affect all incorporated professionals. You must have a considerable investment portfolio for your total adjusted investment income to exceed $50,000. Young incorporated professionals who do not have such a substantial portfolio are therefore usually unaffected.

Note that when the threshold of $50,000 is reached, there may be no financial impact if the professional’s income does not reach $500,000. In addition, a professional who has high investment income in retirement and no longer earns business income would not be affected by these measures.

The fdp team at your service

In any case, feel free to contact an fdp advisor. to see how the business limit measures apply to you. We work closely with our advisors to find the most effective solutions that best suit your unique financial profile. Take advantage of our financial intelligence to make your best business decisions.

Anik Bougie, LL.M. Fisc., F. Pl., TEP

Practice Leader, Financial Planning and Taxation

Professionals’ Financial – Mutual Funds Inc. and Professionals’ Financial – Private Management Inc. are wholly owned by Professionals’ Financial Inc. Professionals’ Financial – Mutual Funds Inc. is a portfolio manager and a mutual fund dealer which manages the funds of its family of funds and which offers financial planning advisory services. Professionals’ Financial – Private Management Inc. is an investment dealer member of the Investment Industry Regulatory Organization of Canada (CIRO) and the Canadian Investor Protection Fund (CIPF) which offers portfolio management services.

The information contained herein has been obtained from sources deemed reliable, but we do not guarantee the accuracy of this information, and it may be incomplete. The opinions expressed are based upon our analysis and interpretation of this information and are not to be construed as a recommendation. The tax strategies mentioned in this article may not apply in all cases. For any questions, don’t hesitate to contact your Wealth Management Advisor or your tax specialist, accountant or legal advisor.

The data and information provided by fdp and other sources are considered reliable at the time they are presented. However, despite its best efforts, fdp cannot guarantee that they are accurate and complete, or that they are up to date at all times. The information contained in the pages of this document is not intended to provide specific legal, accounting, tax or other advice, and it should not be relied upon in that regard. fdp is in no way liable for any damage incurred through use of the information contained in these pages.