Professionals’ Financial always makes it a point to offer you a range of mutual funds that respond to your needs as an investor. All asset classes are represented in our offer, in addition to funds developed to respond to changing markets. With a view to optimal performance, we also call upon specialized external manager firms, while relying on the expertise and experience of our team of internal managers.

What tangible benefits do these external managers bring to your investment portfolio?

Some core principles

Constructing a good investment portfolio requires integrating some key principles that are followed by all managers. One of the most important is certainly diversification.

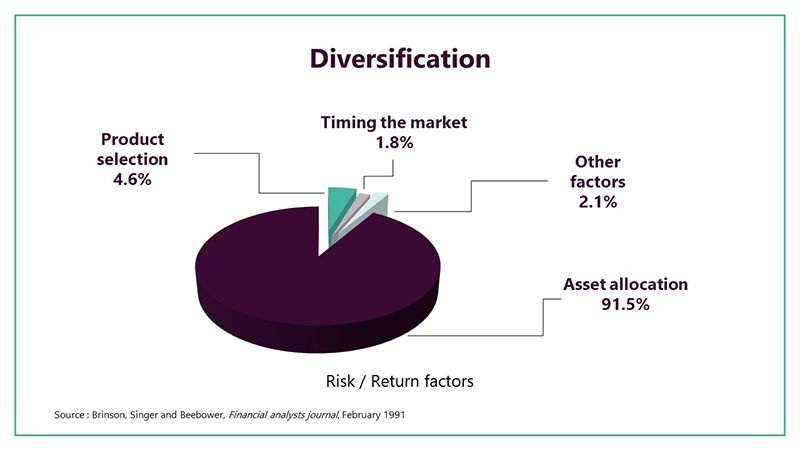

Brinson, Singer and Beebower[1] show in the chart below that more than 90% of portfolio performance and stability is attributable to its diversification.

It is therefore important to diversify by:

- Asset class (equities versus fixed income)

- Geography (continents, countries)

- Sector (financial, industrial, health, telecom, basic materials, consumer discretionary, etc.)

- Management style of the managers (value, growth, income, momentum)

The ups and downs of the markets

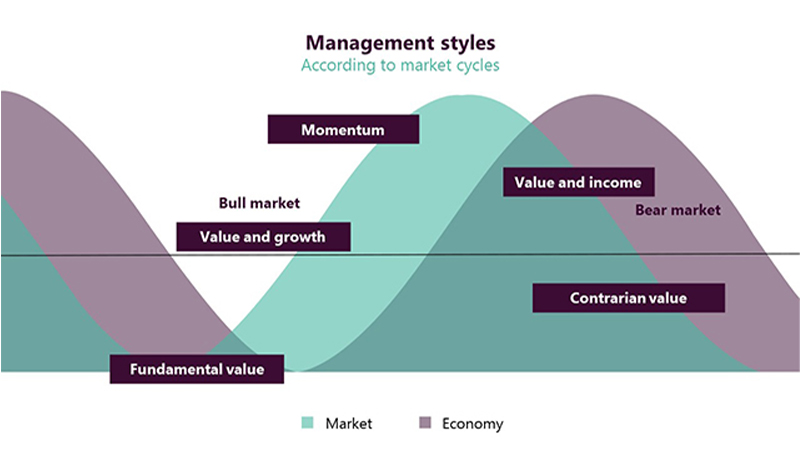

As part of this approach, using different external managers is key. Like the overall economy, stock markets are cyclical, and each of the different management styles will tend to outperform in a specific phase of the financial cycle. The growth style will produce better results in the up phase of the cycle, while the value style will be better in the contraction phase since it better protects capital.

Having several external managers whose management styles are complementary, whether within the same portfolio or within the same fund, allows for diversification of the return components and adds value, regardless of the phase in the stock market cycle.

A question of style

Each manager always develops its own style at which it excels. Some adopt the value style, while others favour the growth style. To optimize the risk/return ratio, the objective is to combine different styles which are complementary to maximize diversification, and consequently the return per unit of risk. This exercise must, however, be well structured. It is not enough to invest in all the styles to obtain a superior return. It is the right amount of the different styles, in keeping with the client’s objectives, that will optimize a portfolio according to the client’s profile.

Learn more about the different management styles.

An example to illustrate

To concretely demonstrate the effect of a multi-manager strategy, let’s look at our FDP Canadian Equity Portfolio. It has three managers whose styles are very different:

- Fidelity Investments Canada: growth-at-a-reasonable-price style

- Triasima Inc.: hybrid style applied to all caps

- Manulife Investment Management Ltd.: The manager looks for high-dividend paying stocks. This is a low-volatility style that benefits from solid, well-established companies and relies on dividends to generate an attractive and steady return.”>dividend income style

This combination of complementary styles has helped improve the performance of the fund which, year to date, has a percentile rank of 5 in its category in the Morningstar ratings.[2]

Key word: diversification!

A manager can, for different reasons, change its management style. To maintain the proper balance in the portfolio or fund, we then have to assess the suitability of this new management style and whether it complements the strategies already in place to generate a good overall performance. If the new management style no longer contributes to the desired diversification, we choose a new manager to restore the complementarity required for the fund strategy to work.

In any case, bear in mind that in the current market climate, diversification remains the best strategy to protect your assets and achieve return. The experience and skills of seasoned managers are your best assets.

Have questions about your portfolio? Your advisor has all the answers!

[1] BRINSON Gary P., SINGER Brian D. and BEEBOWER Gilbert L., Determinants of Portfolio Performance II: An Update, Financial Analysts Journal, Volume 47, 1991, issue 3.

[2] Source: Morningstar Inc. The percentile rank is a fund’s rank relative to 100 funds in the same category, a percentile rank of 1 being the top in its category.

Management styles

Understanding

Here is a brief description of each of the styles commonly used by portfolio managers:

Value: The manager looks for undervalued stocks. Their price must be lower than the manager’s target price. Although it benefits in rising markets, the value style produces better results when markets are falling. It is usually less volatile, with low security turnover.

Growth: This style emphasizes current and future company earnings. The price paid for a stock is less important: the focus is on growth potential. This style is usually more volatile.

Income: The manager looks for high-dividend paying stocks. This is a low-volatility style that benefits from solid, well-established companies and relies on dividends to generate an attractive and steady return.

Growth at a reasonable price: The manager looks for stocks that have high potential but that are selling at a reasonable price. This is a hybrid style that combines value and growth.

Momentum: The manager seeks big short-term gains. Characterized by high turnover, this style invests in stocks that are in strong uptrends, without regard for the price. It performs well in times of euphoria at the end of bull markets.

Fundamental value: The manager looks for shares that are extremely undervalued by the market but that are issued by solid companies (e.g. Microsoft or Apple after the tech crash of 2001).

Contrarian value: The manager looks to buy stocks that nobody wants, to take advantage of their potential rebound.