Since the federal budget of March 22, 2016, many doctors working within a partnership (GP or LLP*), commonly called a “services pool,” have been wondering about the impacts of the budget changes on their pool and their personal situation. Are the repercussions of the latest budget as negative as some claim? Here is a concrete example.

Emily EmilyProfession: gynecologist obstetrician Incorporation: incorporated her practice 4 years ago, working in a pool of 10 doctors Corporate income : $400,000 (after expenses and before taxes) Emily’s compensation: dividends |

LLP* LLP*

*Limited liability partnership |

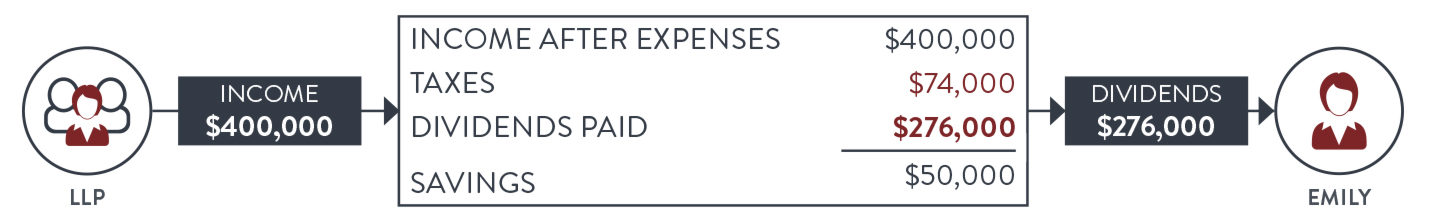

Emily’s situation before March 22, 2016

- Emily’s corporation was eligible for the Small Business Deduction (SBD) on the first $500,000 of active business income.

- Since the income earned by the corporation is less than $500,000, the combined tax rate (federal and provincial) was 18.50%.

Beginning in 2017

![]() Since March 22, 2016

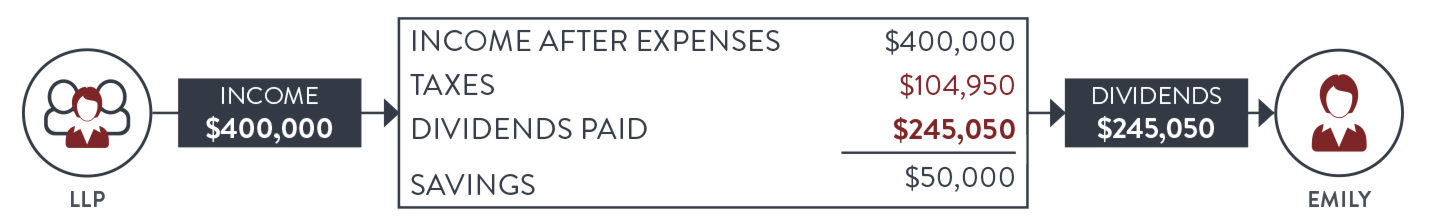

Since March 22, 2016

For corporations that provide services to a pool, the specified partnership income limit of $500,000 must be shared among all the partners in the pool. This measure applies to the corporation’s taxation years beginning after March 22, 2016.

- The fiscal year-end of Emily’s corporation is December 31, 2016: beginning in 2017, she will no longer be able to fully benefit from the SBD.

- The $500,000 business limit will be shared among the 10 gynecologists in the pool.

- For the purposes of the case study, we will assume that $50,000 of Emily’s corporate income (1/10 of $500,000) will be eligible for the SBD; the other income (not eligible for the deduction) will be taxed at a higher rate, i.e. 26.80%.

Provincial budget and 5,500 hours

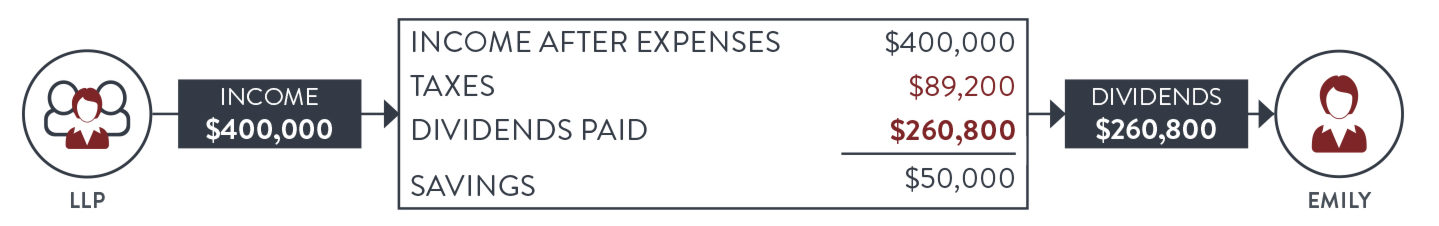

How much tax would Emily’s corporation have to pay in 2017 if she no longer belonged to the pool?

- Beginning January 1, 2017, Quebec corporations whose employees work fewer than 5,500 hours in a year will no longer be able to fully benefit from the SBD.

- Since Emily has only one employee (herself), her corporation will no longer be eligible for the SBD.

Ordinary and eligible dividends

At first sight, it seems financially preferable for Emily to no longer belong to a pool beginning in 2017 since she could then receive a bigger dividend, while saving $50,000 per year in her corporation. However, it should be noted that the dividends paid by Emily’s corporation will be taxed differently, according to whether or not she is in a pool.

| Situation in 2016 | Situation in 2017 with pool | Situation in 2017 without pool | |

|---|---|---|---|

| Dividends | $270,000 | $245,050 | $260,800 |

| Taxes | $94,000 | $70,550 | $87,300 |

| Net income | $182,000 | $174,500 | $173,500 |

- With pool: Since the corporation pays more tax, it will be able to pay eligible dividends, which are taxed at a lower rate.

- Without pool: The corporation pays less tax, but will have to pay ordinary dividends, which are taxed at a higher rate.

The takeaway?

The budget changes should increase taxes for incorporated doctors, regardless of their practice structure. However, in most cases, remaining in a pool should have no negative effect, as shown in our case study. In fact, the new rules create an opportunity to review your partnership agreement, not an obligation to discard a practice arrangement that offered many non-tax benefits. It’s a chance to simplify the functioning of your pool.

The Financial has the necessary expertise to guide you in this regard. Discuss your concerns with your advisor.