For an analysis of your situation, get in touch with one of our advisors

1 844 854-6055Toll free

Contact us

How to invest

How to invest

Is the financial world a mystery to you? Do you know a little bit about it, but still find it perplexing? Would like to learn how to invest? If you answered yes to any of these questions, we can help you make sense of it all.

Your portfolio

Your investments are strategically allocated in different fund categories and are held in a portfolio.

Depending on the size of your investments, Wealth Management

or Private Management Advisors look after your interests and optimize your portfolio.

A as in assets

Buy why make investments? Because you have projects to carry out: travel, home, paying for your children’s education, retirement, or other. Because investing wisely can help you protect and grow your assets, at each stage of your life.

Understanding the ecosystem

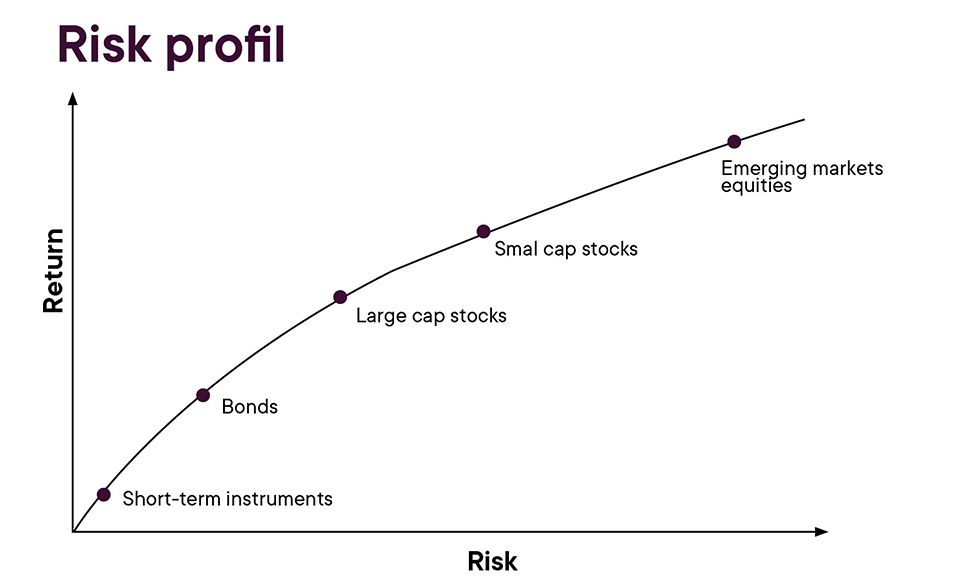

Your risk tolerance and your goals determine the types of investments that will be recommended for you:

- Short-term investments

- Medium-term investments

- Long-term investments

It’s here that our advisors play a key role, by helping you choose the optimal investments for your situation. Ideally, you should have a diversified investment portfolio to maximize your returns.

A good basic plan

Registered plans are an excellent savings vehicle. They offer tax benefits, including tax deferral. Most of these plans enable you to save for retirement or for other projects, depending on your life stage and your needs. Except for the TFSA, investments in these plans are:

- Tax deductible

- Taxable when withdrawn

| Accounts and plans – Registered investments | |||

|---|---|---|---|

| All projects | Retirement | Education | Home |

|

Sums accumulated in the plan can be reinvested in other financial products. |

|||

TFSA or RRSP? Plans that pay off!

You can save $6,000 a year tax free regardless of your income with a TFSA and/or invest 18% of your earned income of the previous year in a RRSP, up to a limit of $27,830 in 2021. Effective use of these two tools can prove very profitable as part of your investment strategy.

Choose the right vehicle

If contributing the maximum to your RRSP does not enable you to save enough for your retirement or for a specific project, opt for a TFSA and non-registered plans to grow your savings. The returns and the tax you will have to pay will vary according to the type of product you choose.

Stay within your limits

Call on an investment advisor to help you:

- Determine your investor profile and your risk tolerance

- Develop a savings plan tailored to your personal and professional situation

Know the funds

There is a wide range of mutual funds to choose from, but which one should you invest in? To identify the fund that’s right for you, make sure that the fund’s objectives match yours and that the risk level is suitable. Read the fund profiles for an overview and make an informed decision with the help of your advisor.

R as in Returns

Fund performance and the growth of your assets are tied to market performance and to many factors that can cause your investments to rise or fall in value. Generally, the higher the projected return, the greater the risk.

Watch the indices

Market sensitivity is expressed in terms of volatility. The main causes of return fluctuations are:

- economic cycles (the level and direction of corporate earnings)

- geopolitical crises and /or events that polarize attention

- the level and direction of interest rates

- fear and greed

Mitigate risk

How should you act in different market situations? First, don’t be swayed by your emotions. Remember that your advisor is there to keep an eye on things, especially when volatility is high. Your advisor can prevent serious mistakes that could prove costly to you.

Be informed

Approaches and strategies

Diversifying income sources and choosing the right investment vehicles are key factors for improving your portfolio. In the midst of the action, fdp’s internal and external fund managers stand out for their approach and their strategies.

These top experts know the ins and outs of the market and can maximize returns while protecting our clients’ assets.