Yann Furic

B.B.A., M. Sc., CFA®

Senior Portfolio Manager, Asset Allocation and Alternative Strategies

What moved the markets:

No Fed rate hike.

Slowdown of the Canadian economy.

|

OVERVIEW OF GLOBAL EQUITY MARKETS |

||||

|

Country |

Index |

Return |

Change |

Year-to-date return |

|

Canada |

S&P/TSX |

-3.21% |

|

0.06% |

|

United States |

S&P 500 |

0.52% |

|

13.41% |

|

|

Nasdaq |

-0.15% |

|

26.64% |

|

International stock markets |

EAFE |

-1.48% |

|

5.26% |

|

Emerging markets |

|

-1.31% |

|

0.27% |

|

China |

MSCI China |

-1.70% |

|

-9.06% |

* All percentages are in Canadian dollars. Source: Morningstar Direct.

Results – Canadian bonds

The FTSE Canada Universe Bond Index has posted a negative return of 1.09% year to date (at October 31, 2023).

Source : Morningstar Direct.

Our analysis of events

The rate hikes seem to be working

At its November 1 meeting, the U.S. Federal Reserve (Fed) announced its decision not to raise its key interest rate. However, it did not rule out future rate hikes and made it clear that rates are likely to remain high for an extended period. Despite multiple rate increases, the U.S. economy continues to grow.

As for the Bank of Canada, at its meeting on October 25, it announced no change to its policy rate. Some positive effects have been observed in recent months, justifying the status quo: the Canadian economy is gradually slowing, and the job market seems to be stabilizing.

If the economic situation in Canada and the U.S. were a fable…

Apart from people who work in the financial field, it can be difficult for the average person to differentiate between monetary policy and fiscal policy.

For several months now, numerous articles have been discussing the negative effects of fiscal policy versus monetary policy in North America. To illustrate the behaviour of governments and central banks, we’ll take some liberties with a well-known fable by La Fontaine: The Grasshopper and the Ant.

For over a year now, the U.S. and Canadian central banks have been raising interest rates to curb demand for goods and services and slow economic growth, with the aim of reducing inflationary pressures. Since the North American economy is largely driven by consumers, reducing demand for goods and services should moderate economic growth and, consequently, lead to an easing of rate hikes. This is known as monetary policy. These numerous and sustained rate hikes are rather unpleasant, hence the comparison with the tireless work of the Ant.

Meanwhile, many government bodies continue to spend at a frantic pace, as if there were no limits and no negative effects of creating deficits and increasing debt – like the Grasshopper.

For over a year now, central bank monetary policies have been restrictive, with a view to periods of weaker economic growth, while fiscal policies have been expansionary. As interest rates rise, making new loans more expensive, some government bodies, in a bid to curb inflation, send out cheques to help cover these higher costs, thereby actually contributing to inflation. In such a situation, monetary and fiscal policies run directly counter to each other.

It is becoming increasingly clear, and many seem to have realized, that government bodies must limit their spending, or at the very least create targeted assistance programs, otherwise they will find themselves facing deficits and large interest payments on their debts during an economic downturn.

In conclusion, the Grasshopper needs to change its behavior so that the Ant can consider its job done and inflation can return to the 2% target.

Employment situation

In October, 17,500 jobs were created in Canada, when expectations were for 25,000. Wage inflation fell from 5.3% to 5% year over year, while unemployment rose from 5.6% to 5.7%.

In the U.S., job creation also came in under expectations in October, with 150,000 jobs added versus forecasts of 180,000. The unemployment rate edged up and wage inflation remained below expectations. These results could enable the Fed to keep its key rate unchanged.

Third quarter earnings

Canadian and U.S. companies began to report their results for the third quarter of 2023 and give their forecasts for the next quarter.

On the S&P 500, sales, and especially corporate profits, are beating expectations. Canada’s S&P/TSX also posted encouraging numbers, in terms of both sales and earnings.

Commentary concerning the next quarter was mixed. A slowdown in consumer spending should help reduce inflationary pressures and facilitate the role of central banks.

Economic indicators

Global Purchasing Managers’ Index ![]()

Once again in October, the indices show a difference between the manufacturing economy, which is slowing, and the services component, which continues to grow but which, once again, is decelerating.

Inflation rate ![]()

The inflation rate is still too high, but certain indicators are moving in the right direction. Wage inflation in Canada is still too strong.

Benchmark rates in Canada, Europe and the United States ![]()

If interest rates remain at current levels for an extended period, this will have a major impact on household and business spending when loans are renewed. This situation will further dampen household consumption and investment.

Our strategic monitoring

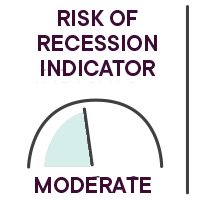

We have maintained a cautious approach throughout 2023.

We are keeping track of inflation as well as the leading indicators for manufacturing production, the services sector and employment. A deterioration in these numbers would prompt us to be even more cautious.

A notable improvement in the manufacturing indices combined with a return to an inflation rate of 2% would be strong signs of an economic recovery, but above all of a possible soft landing for the economy.

Fourth quarter earnings estimates for S&P 500 companies are stabilizing, but valuations remain high.

Caution and risk management remain priorities.

Our tactical positioning

Tactically, we maintained our position in U.S. large cap growth stocks which react positively to stabilizing interest rates, as well as in stocks with a track record of dividend growth which are more defensive.

We continue to favour large cap stocks in developed countries.

Since the Bank of Canada’s policy rate increase in early June, we have taken a position in 10-year Canadian bonds, since we believe that longer-term rates will peak over the next few months and then stabilize or decline.

We increased the weighting of 10-year Canadian bonds in July and August, as well as in the early days of October.

To learn how our funds performed:

View the returns

Main risks

- An overly restrictive monetary policy could cause a major recession or other problems, like the U.S. regional bank crisis.

- High interest rates for an extended period would reduce corporate profits and sharply curtail household spending.

- The possibility of an episode of stagflation, i.e. anemic economic growth and high inflation, persists. This situation is negative for stock markets.

- The Israel-Hamas conflict could escalate and spread throughout the Middle East.

- The conflict in Ukraine could spread to other European countries. Grain prices could increase following Russia’s cancellation of the maritime transport agreement in this region and contribute to food inflation.

- There is also a risk that tensions could worsen between China and the United States over Taiwan.

Senior Manager, Asset Allocation and Alternative Strategies

Data source : Bloomberg

The opinions expressed here and on the next page do not necessarily represent the views of Professionals’ Financial. The information contained herein has been obtained from sources deemed reliable, but we do not guarantee the accuracy of this information, and it may be incomplete. The opinions expressed are based upon our analysis and interpretation of this information and are not to be construed as a recommendation. Please consult your Wealth Management Advisor.